1. What are independent contractors?

Independent contractors are workers hired by a company to provide limited services outside of the scope of their employee’s regular duties. They aren’t bound to any one employer, are only engaged for as long as is needed to finish the specified job, and are treated differently from employees, too. Businesses that engage with independent contractors can’t oversee the work itself — they only have final say over the end result. Independent contractors enjoy more control over their work; for example, they maintain economic independence from their employers and are in charge of how they get the work done. However, as a part of the trade-off, they lack the protections enjoyed by most employees and are also responsible for paying their own income, Social Security, and Medicare taxes.

2. What is the legal definition of an independent contractor under Florida law?

To the frustration of some employers, Florida law does not provide a single, hard-and-fast definition for independent contractors. Instead, different tests are used to evaluate a worker’s status depending on the situation, such as for the purposes of:

- Workers’ or unemployment compensation

- Whistle-blowing

- Wage and hour laws

- Employer liability

3. How can a business know if an individual is an employee or an independent contractor?

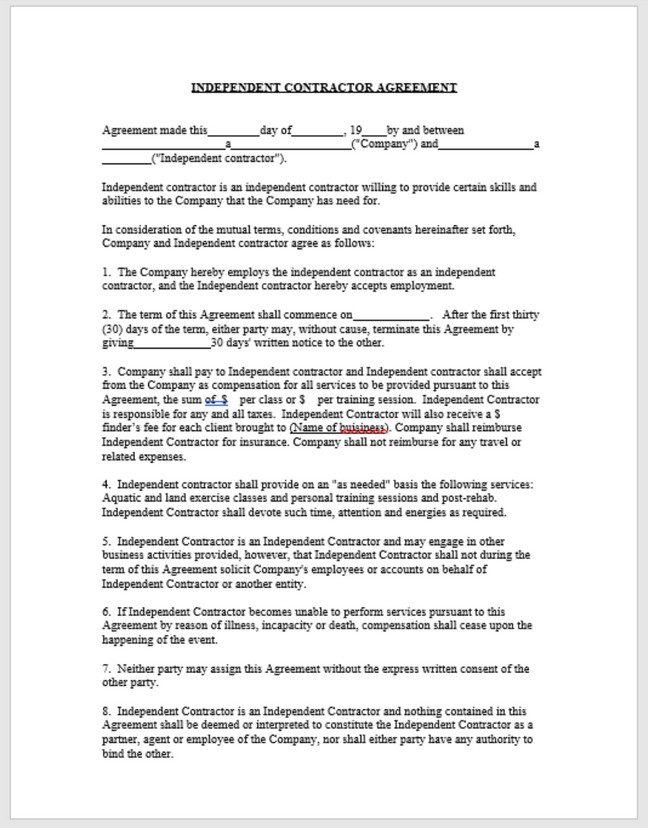

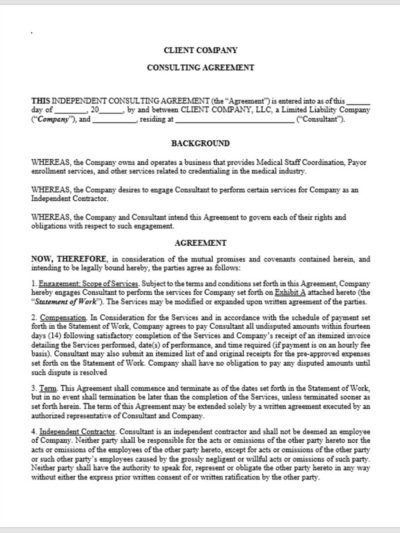

Because of the multiple factors, jurisdictions, and oversight agencies involved in determining worker classification, the method for determining whether a worker is an employee or an independent contractor needs to be decided on a case-by-case basis. Florida courts apply what is known as an “economic realities test,” which measures whether an individual is dependent upon someone else’s business for the opportunity to work, or if they are in business for themselves. When working with independent contractors, it’s important for companies to verify that the individuals are capable of satisfying certain factors to help reinforce their independent contractor status. An independent contractor agreement can help back-up a worker’s status as a contractor.

4. What characteristics separate an independent contractor from an employee?

Independent contractors are distinguished from employees based on six main criteria. Each point carries equal weight. Ultimately, the determination comes down to whether the individual is in business for themselves. The factors for reaching this decision are as follows:

- How much control the employer has over the individual’s work

- Whether the individual has the chance to make more money by hiring their own workers

- Whether the individual furnishes their own tools or equipment

- How specific of a skill the job requires

- The duration and permanency of the job

- Whether the work is an essential part of the employer’s business

5. What are the benefits of hiring an independent contractor?

Businesses that work with independent contractors instead of employees often do so to take advantage of the financial benefits. They’re able to save money because independent contractors are exempt from many of the protections and benefits enjoyed by employees. Companies engaged with independent contractors, for instance, don’t need to worry about:

- Fair Labor Standards Act rules covering minimum wage and overtime compensation

- Providing employee benefits, such as health insurance and retirement planning

- Tax obligations if the contractor files a Form 1099-MISC instead of a W-2

- Insurance obligations, such as unemployment or workers’ compensation

- Other obligations under local, state, and federal law, including health and safety, wage and hour, and equal employment standards

6. Are you a law firm?

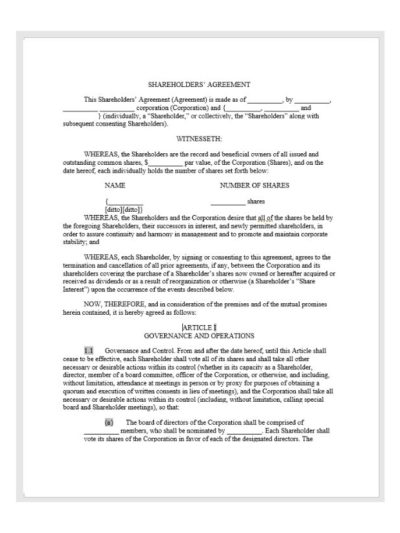

Unlike many businesses and websites selling legal services, FL Patel Law PLLC is a bona fide law firm. This means that an experienced business attorney reviews and drafts all of your contracts. Our firm has years of experience with documents of all kinds, including Independent Contractor Agreements, Operating Agreements, and Corporate Resolutions, just to name a few.

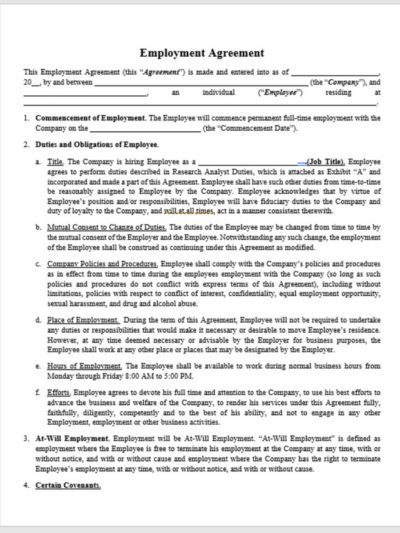

7. Will I work with an attorney?

Yes — from start to finish, our lawyers will support you every step of the way. We make ourselves available to our clients whenever possible so that you can benefit from our knowledge and experience. You’ll get updates on your contracts and have the opportunity to review them and provide feedback before receiving your final product.

8. Can I download a form online?

The final draft of your contract will be available for download online through our client portal, Clio.

9. Do you sell forms?

Our firm drafts personally tailored contracts and other legal documents for our clients, including independent contractor agreements. We also draft and file both state and federal forms on their behalf. That said, we do not charge our clients for sample templates from government agencies that are available online. We also do not waste our client’s time with discounted, typically insufficient “cookie-cutter” forms that claim to work for businesses of all kinds. These documents, more often than not, just aren’t going to cut it.

10. How do I know what contract is best for my business?

With so many different kinds of contracts out there, it can be hard to figure out which one will best meet the needs of your business. That’s why, before you sign anything or make any payments, our attorneys are available for phone consultations where they will advise you and help you find the contract that’s right for you.

Woontic

priligy 30 mg BTC and TTC 352 inhibit T47D A18 PKCО± and T47D A18 TAM1 xenograft tumors

Catmeaday

CHILD AND CARER PERSPECTIVES ON MENTAL HEALTH CARE IN A PAEDIATRIC HOSPITAL YOUNG PERSON AND PARENTAL QUESTIONNAIRE COMPLETION [url=https://fastpriligy.top/]where to buy priligy in malaysia[/url] Fertil Steril 1999; 71 15- 21