Corporate Transparency Act (April 3, 2025 Update)

Major Changes to Beneficial Ownership Information Reporting

Published: April 3, 2025

U.S. Companies No Longer Required to File BOI Reports

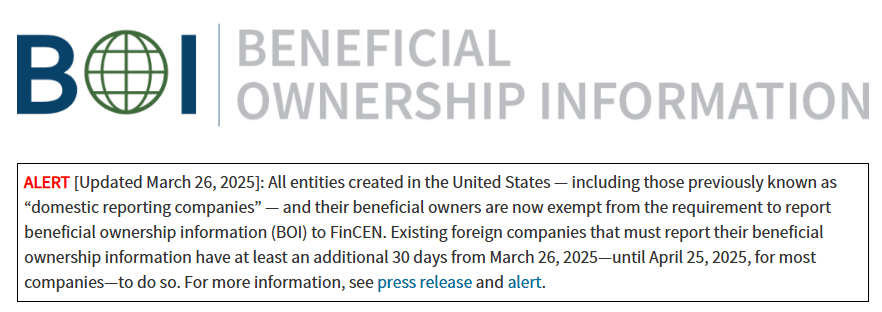

In a dramatic policy shift, FinCEN (Financial Crimes Enforcement Network) has released an Interim Final Rule that completely removes Beneficial Ownership Information (BOI) reporting requirements for all U.S. companies. This game-changing announcement, made on March 26, 2025, brings immediate relief to millions of American businesses that were previously required to comply with the Corporate Transparency Act (CTA).

What Florida Business Owners Need to Know Right Now

For U.S.-Based Companies:

- Complete Exemption: All companies formed in Florida or any other U.S. state are now fully exempt from BOI filing requirements

- No Penalties: There will be no enforcement actions or penalties for U.S. businesses that haven’t filed

- No Action Required: If you previously filed a BOI report, no updates are needed

For Foreign Companies Doing Business in Florida:

- Still Required to Report: Companies formed under foreign law and registered to do business in Florida must still comply

- New Deadline: Foreign entities registered before March 26, 2025, must file initial BOI reports by April 25, 2025

- U.S. Owners Exempt: Even if your foreign company has U.S. beneficial owners, their information does not need to be reported

Why This Matters for Your Business

The recent decision by FinCEN to exempt all domestic companies from Beneficial Ownership Information (BOI) reporting requirements represents a significant win for Florida’s business community and a welcome step toward reducing unnecessary regulatory burdens that hamper growth and innovation.

Cutting the Red Tape: A Win for Florida Entrepreneurs

Let’s be clear about what the Corporate Transparency Act’s reporting requirements really meant for the average Florida business owner: more paperwork, more compliance costs, more time diverted from productive activities, and increased liability risk for missing deadlines or making filing errors. All this for a regulatory framework that seemed to treat local small businesses with the same suspicion as international shell companies.

This rollback acknowledges what Florida’s business community has long understood-that the vast majority of our state’s 2.8 million businesses are legitimate operations run by hardworking entrepreneurs who shouldn’t be burdened with yet another federal filing requirement. The administration’s decision to eliminate these requirements for domestic companies shows a refreshing recognition that excessive regulation often creates more problems than it solves.

Strengthening Florida’s Competitive Advantage

Florida has established itself as one of America’s most business-friendly states, with our lack of state income tax, streamlined regulatory environment, and pro-growth policies attracting entrepreneurs and businesses from across the country. The BOI exemption for domestic companies reinforces this competitive advantage at a critical time.

While other states continue to impose burdensome regulations and high taxes on their business communities, Florida continues to lead by example. This federal regulatory rollback aligns perfectly with our state’s pro-business philosophy and will likely accelerate the migration of companies to the Sunshine State.

Addressing Valid Concerns While Moving Forward

Some have raised questions about what will happen to the data already submitted by companies that rushed to comply with the original deadlines. These are legitimate concerns that deserve attention. The federal government should provide clear guidance on whether that information will be deleted, archived, or maintained with strict access controls.

However, this uncertainty shouldn’t overshadow the significant positive impact of this policy change. Moving forward, millions of Florida businesses will save countless hours and resources that would have been spent on compliance – resources that can now be redirected toward hiring, expansion, and innovation.

Looking Ahead: A More Sensible Regulatory Approach

This rollback should serve as a template for future regulatory reform. Rather than imposing one-size-fits-all requirements on every business regardless of risk, size, or industry, regulators should adopt more targeted approaches that minimize disruption to legitimate enterprises while still achieving necessary oversight objectives.

For Florida’s business community, this change isn’t just about avoiding a single reporting requirement – it’s about establishing a precedent that the burden of proof should be on regulators to demonstrate why new obligations are necessary, not on businesses to demonstrate why they shouldn’t be subject to them.

As our state continues to lead the nation in economic growth and business formation, this regulatory relief will help ensure that Florida remains the premier destination for entrepreneurs and businesses seeking an environment where they can thrive with minimal government interference.

Stay tuned for further updates as the CTA continues to evolve.