How to Tell If an LLC Will Benefit Your Florida Business

LLC Benefits for Florida Business Owners and Entrepreneurs While it’s common knowledge that there are a lot of benefits that come with forming an LLC in Florida, it’s not a one-size-fits-all business entity. In order to know if an LLC is really your best option, …

7 Tips for Your Next Business Check Up

7 Tips for Your Next Business Check Up Regularly checking up on the specifics of your business can go a long way to preventing problems before they get out of hand. Let’s go over some of the main areas that you’re going to want to …

What’s the Purpose of a Florida LLC?

What’s the Purpose of a Florida LLC? Liability protection is important in any business. However, sole proprietorships and general partnerships are particularly vulnerable to lawsuits. One solution, particularly popular among small business owners, is to set themselves up as a Florida LLC. Liability Protection An …

How to Form an S Corporation in Florida

How to Form an S Corporation in Florida An S-Corp is a Florida Limited Liability Company or a Florida Corporation that elects to be taxed under Subchapter S regulations of the tax code. In order to elect to be taxed as an S Corporation, you …

Converting to (or From) an LLC

Converting to (or From) a Limited Partnership to LLC Businesses can expand and change at a rapid pace. The structure that fit at the time you started your business may no longer fit. If your business is expanding at a fast pace or needs capital …

Limited Liability Companies Compared to Corporations

Limited Liability Companies or LLCs Compared to Corporations Corporations and LLCs are similar when it comes to not having to worry about unlimited liability when starting your business. When it comes to creating the LLC state laws give some advantages to LLCs over corporations. LLC …

LLCs Compared to General Partnerships and Sole Proprietorships

LLCs Compared to General Partnerships and Sole Proprietorships Compared to general partnerships, and sole proprietorships LLCs offer the best benefits. Most partnerships and sole proprietorships switch to LLCs because they offer more advantages. Advantages of an LLC The main advantage an LLC has over general …

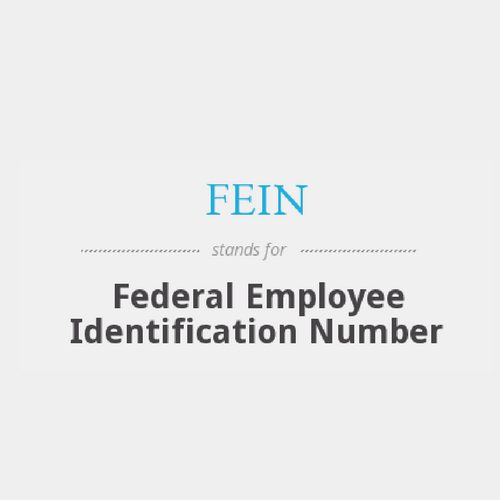

What is An EIN and Why is it Important?

What is an EIN and Why is it Important? What is it? An EIN is a unique nine-digit number that you obtain from the IRS for tax purposes. It is a number that identifies your business. Business owners need to have an EIN. It is …

Frequently Asked Questions About LLCs

Frequently Asked Questions About LLCs Here are the answers to the most common questions our clients ask us about forming an LLC in Florida. Q. What Statute is the Limited Liability Company governed by in Florida? LLCs in Florida are governed by the Florida Revised Limited …

LLC v. S-Corp

LLC v. S Corp We get a lot of clients who come to us to form an “S Corporation.” They are often surprised to hear that there is no such thing as forming an S Corporation, also called an S Corp, in Florida. This type …