1. What is an Employment Agreement?

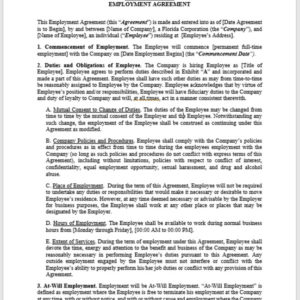

An employment agreement is a contract that details the working relationship between an employer and an employee. This contract can either be written or verbal, and although verbal contracts are just as legally binding as written contracts, they can be much harder to enforce – but we’ll get into that more below.

Each employment agreement needs to be tailored for the specific job, but just about all of them have a few of the same provisions. These include a description of the job, the term of employment, and employee pay or compensation Some positions in certain industries, however, can benefit from further provisions, such as restrictive covenants and indemnity clauses.

2. What is the Purpose of an Employment Agreement?

Employment agreements exist to make life easier for both the employer and the employee by reducing confusion and lowering the possibility of future disputes. Setting clear expectations from the outset helps keep everyone on the same page, which is essential to a successful employer-employee relationship. These agreements are also useful for limiting personal liability and protecting the company from an employee’s poor conduct.

3. Is a Verbal Agreement Not Enough?

Verbal employment agreements rarely hold up in court. Relying on them for protection could leave your business vulnerable to lawsuits and other penalties. Some employers choose to risk it and forgo written contracts for more casual or flexible arrangements, but this is far from ideal. Getting your employment agreement in writing not only helps shield you from liability but gives you the chance to include “restrictive covenants” to further protect your business from negligent or malicious behavior.

4. How Can an Employer Protect Their Intellectual Property and Other Rights?

A lawyer-drafted employment agreement can safeguard the employer’s IP and other rights through restrictive covenants and other provisions typically left out of an oral contract. These covenants, or agreements, legally prohibit the signing employee from taking certain actions that would run contrary to the business’s interests.

Common restrictive covenants in employment agreements include non-disclosure provisions to protect confidential or proprietary information, non-compete agreements to keep the employee from using company knowledge to start a competing operation, and even non-disparagement clauses to prevent slander against the business.

5. What Minimum Wage Laws Apply to Florida Employers?

Florida employers must follow minimum wage laws at the federal, state, and local levels. Florida’s minimum wage is recalculated annually so that it can be adjusted for inflation, so make sure to check in each year for updates. This adjustment is calculated on September 30th and goes into effect the following January 1st. Some employees might be exempt from these minimum wage laws under specific circumstances, but these are odd exceptions to the rule, so businesses should consult a trusted employment attorney to make sure that they’re still in compliance.

6. Do Tipped Employees Need to Be Paid Minimum Wage?

In Florida, tipped employees are defined as anyone working a job where they can reasonably expect to take home at least $30.00 in tips each month on a regular basis. Florida employers can offer them a reduced direct wage versus non-tipped employees if that wage, when combined with the employer’s tip credit, equals at least the minimum wage. However, workers who spend at least a fifth of their working hours performing non-tipped duties must be paid the full minimum wage for those specific services.

7. Are Florida Employers Required to Pay Overtime?

Yes, according to the Fair Labor Standards Act, Florida employers must pay overtime at a rate of 1.5 times their usual wage to any nonexempt employee working more than 40 hours in a work week.

8. Are you a law firm?

Unlike many businesses and websites selling legal services, FL Patel Law PLLC is a bona fide law firm. This means that all of your contracts are drafted and reviewed by an experienced business attorney. Our firm has years of experience with documents of all kinds, including Shareholders Agreements, Operating Agreements, and Corporate Resolutions, just to name a few.

9. Will I work with an attorney?

Yes — from start to finish, our lawyers will support you every step of the way. We make ourselves available to our clients whenever possible so that you can benefit from our knowledge and experience. You’ll get updates on your contracts and have the opportunity to review them and provide feedback before receiving your final product.

10. Can I download a form online?

The final draft of your contract will be available for download online through our client portal, Clio.

11. Do you sell forms?

Our firm drafts personally tailored contracts and other legal documents for our clients. We also draft and file both state and federal forms on their behalf. That said, we do not charge our clients for sample templates from government agencies that can easily be found online. We also do not waste our client’s time with discounted, typically insufficient “cookie-cutter” forms that claim to work for businesses of all kinds. These documents, more often than not, just aren’t going to cut it.

12. How do I know what contract is best for my business?

With so many different kinds of contracts out there, it can be hard to figure out which one will best meet the needs of your business. That’s why, before you sign anything or make any payments, our attorneys are available for free phone consultations where they will advise you and help you find the contract that’s right for you.