The Risks and Benefits of Converting or Merging Your Own Ohio LLC into a Florida LLC

Relocating, Domiciling, Transferring, Converting, or Merging an Ohio LLC into a Florida LLC

Updated: June 24, 2024

Reading Time: 10 Minutes

Objectives:

- Domicile an Ohio Liability Company (LLC) to Florida;

- Maintain the same EIN and identity of the LLC; and

- Enjoy tax benefits provided to Florida residents.

Entities:

- Ohio Limited Liability Companies

Table of Contents

- What is a Conversion, Merger, or Domestication?

- Does Ohio Allow LLCs to Move Out of State?

- Is My Ohio Entity Dissolved?

- Do I Need To Get a New EIN if I Move My Company to Florida?

- How Does FL Patel Law PLLC Merge My Ohio LLC into a Florida LLC?

- How Long Does It Take To Relocate an Ohio LLC to the State of Florida?

- What Are the Costs Involved in Relocating My Ohio LLC to the State of Florida?

- What Are Some of the Risks Associated With a Merger Gone Wrong?

- Increase Your Chances of a Successful Relocation

- What Are the Benefits of Merging My Ohio LLC into a Florida LLC?

- What Are the Tax Implications of Merging My Ohio LLC into a Florida LLC?

- Should I Work With Attorney Patel to Merge My Ohio LLC into a Florida LLC?

Florida has built a reputation as one of the most business-friendly states in the nation. Considering that and the fact that we have no state income tax, it’s no surprise that companies from all over want to know if they can bring their operations to our state. One method for making this type of move is known as a reincorporation merger, which is particularly useful for businesses like Ohio LLCs that want to become Florida entities.

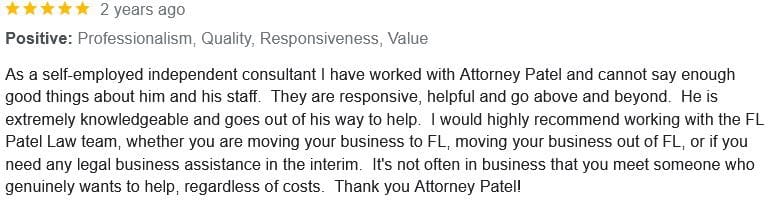

Relocating a company to a new state is a major undertaking that can pose serious risks to both the business and its owners if things aren’t done the right way. The good news is that FL Patel Law PLLC can be the deciding factor when it comes to ensuring a seamless, successful transition from an Ohio LLC into a Florida LLC. Our firm has successfully reorganized over 140 businesses into Florida entities, which is why you can trust us to have the knowledge and expertise needed to manage your relocation.

This page will review the ways that our firm’s process for mergers and other domestication projects can save them time and money while preserving their company’s corporate identity. It will also go over the risks of attempting this type of reorganization without a law firm’s expertise and assistance.

Mistakes made when executing a merger can have severe consequences for your company, including its liquidation. Keep on reading to learn more about the risks involved with merging an Ohio LLC into a Florida LLC on your own.

What is a Conversion, Merger, or Domestication?

To topBecause Ohio repealed the laws authorizing statutory conversion, our firm uses reincorporation mergers to relocate their operations to Florida. By creating a Florida LLC and merging the Ohio LLC into that new entity, the business can change its formation state without impacting its corporate identity.

Reincorporation mergers are a far more convenient alternative to moving a business by dissolving and restarting it from the ground up in a new state. This helps preserve important relationships, licenses, and contracts. The Ohio LLC’s rights, assets, privileges, and liabilities will also transfer over during the merger.

The Florida Revised Limited Liability Company Act will replace the The Ohio Revised Limited Liability Company Act as the company’s governing law. However, both Acts might apply if the company has a nexus in both states after merging the Ohio LLC into a Florida LLC. Talk to our attorney about this during your consultation to make sure that you stay on the right side of the law.

Does Ohio Allow LLCs to Move Out of State?

To topAccording to Section 1706.71 of the Ohio Revised Code (ORC), an Ohio LLC can become a Florida entity by merging with a Florida LLC. Ohio corporations have a similar option that allows them to domesticate into Florida entities that you can learn about by clicking this link.

(A) A limited liability company may merge with one or more other constituent entities pursuant to sections 1706.71 to 1706.713 of the Revised Code and to an agreement of merger if all of the following conditions are met:

(1) The governing statute of each of the other entities authorizes the merger.

(2) The merger is not prohibited by the law of a jurisdiction that enacted any of the governing statutes.

(3) Each of the other entities complies with its governing statute in effecting the merger.

Is My Ohio Entity Dissolved?

To topNo. Merging your LLC won’t dissolve it, and filing for dissolution isn’t a part of the merger process, either. Ignore any instructions to the contrary, as they are incorrect. A business should only be dissolved when it’s time to close it for good.

Do I Need To Get a New EIN if I Move My Company to Florida?

To topMerging your Ohio LLC into a Florida LLC allows you to keep using the same EIN issued back in Ohio under certain circumstances. Specifically, its continuity must not be interrupted and no other changes can be made to the business – it must be essentially the same entity as before. The answer will, however, depend on your business and how its merger is executed.

How Does FL Patel Law PLLC Merge My Ohio LLC into a Florida LLC?

To topRelocating an LLC to Florida by using a reincorporation merger requires strictly following a series of procedures and navigating different laws across multiple jurisdictions. The specific steps can change depending on the business and its original formation state. What follows is a general overview, not advice or instructions for your company’s relocation. Schedule a time with our attorney now for guidance with reorganizing your company as a Florida entity.

Before starting on any documentation, we first review the client’s business to ensure that a reincorporation merger is the best choice for their relocation. It also gives us the information necessary to create a personalized plan for merging their Ohio LLC into a Florida LLC with its continuity intact.

We provide comprehensive support throughout the merger process that includes:

- Drafting the Plan of Merger and other required documents

- Ensuring compliance with the laws and other legal requirements in both states

- Filing the necessary documents with Ohio and Florida state agencies

- Updating the LLC’s operating agreement and other corporate documents to reflect the merger

- An exit consultation to address final concerns and questions

How Long Does It Take To Relocate an Ohio LLC to the State of Florida?

To topWith the support of our corporate attorney and our experienced legal team, your Ohio LLC can be successfully merged into a Florida LLC in about two or three months. After helping reorganize over 140 companies into Florida entities, our firm has developed a refined, efficient, and dependable procedure for handling mergers and other types of domestications. That kind of history means that we know how to look out for your business’s interests without wasting any time.

Keep in mind that any mistakes you make handling your own merger can lead to significant delays. As it is, the state agencies responsible for these filings are often already slowed down by backlogs, short staffing, and other issues. Working with a law firm helps ensure that your documents are drafted and filed correctly for your merger, which is an important part of keeping things on schedule and under budget.

What Are the Costs Involved in Relocating My Ohio LLC to the State of Florida?

To topIn addition to paying $125.00 to form the Florida entity that will facilitate your company’s relocation, you’ll also need to pay merger filing fees, which differ from state to state, Ohio’s is $99.00 and Florida’s is $25.00, which comes to a total of $249.00 just to get your paperwork processed. Remember that this number will only grow higher with each and every mistake made when merging the Ohio LLC into a Florida LLC.

Our firm provides flat fees for our LLC merger and relocation services, which can make planning and budgeting for the move far less stressful and far more convenient for our clients. The cost given for the project is based on the complexity of the client’s business and the move itself. Schedule a consultation with our attorney now to get a quote for your Ohio LLC’s merger.

What Are Some of the Risks Associated With a Merger Gone Wrong?

To topBoth your LLC and its members can be exposed to serious dangers and penalties by attempting a reincorporation merger without reliable legal guidance. Working with an attorney, however, can help you avoid these mistakes, along with the delays, additional costs, and other problems that come along with them.

The risks of trying to merge your Ohio LLC into a Florida LLC without a lawyer’s help include:

- Noncompliance with state laws

- Revocation of the LLC’s operating authority

- Damaged credit standing

- Damaged relationships with clients and vendors

- Disrupted contracts

- Loss of business continuity

- Loss of limited liability protection

- Tax implications and increased tax liabilities

- Legal disputes

- Dissolution or liquidation

- Missed opportunities

- Expensive fines

- Painful delays

- Taxes on Appreciated Assets – Depending on the LLC’s tax structure, its members could end up paying income taxes on appreciated assets if they make any errors during the merger. For instance, if an asset that was worth $100,000 at the company’s founding is now worth $1 million, and the company is mistakenly dissolved or liquidated, then the members could be taxed on the gained value.

- Title of Asset Issues – Another benefit of merging an Ohio LLC into a Florida LLC is that asset titles will automatically transfer over to the resulting entity – that is, assuming the merger was handled correctly. This can make it difficult to prove ownership of those assets, which can cause major headaches when trying to sell a company, among other problems.

Be mindful that these are only some of the risks of going forward with this project alone.

Our firm has helped relocate over 140 businesses to Florida, and that undeniable track record means that your company is in safe hands when you hire us to merge your Ohio LLC into a Florida LLC.

Increase Your Chances of a Successful Relocation

To topA project as important and significant as moving your company to Florida deserves the security and convenience that comes with an attorney’s assistance. Our firm is equipped to support our clients across multiple areas of law, both during and after their relocation.

What Are the Benefits of Merging My Ohio LLC into a Florida LLC?

To top1. Your LLC can avoid the hassle of filing with the State of Ohio ever again after its merger if the move breaks its economic nexus in that state.

2. Bringing your business to Florida means that you can work with Florida professional accountants, attorneys, and other service providers after merging your Ohio LLC into a Florida LLC.

3. A properly conducted merger means that you can relocate your LLC without interrupting its continuity or ability to transact business.

4. The Ohio LLC’s formation documents will be automatically replaced by Florida Articles of Organization during its merger.

5. Members will have the same amount of interest in the LLC that they did before the merger. The company’s real estate rights, other property rights, and liabilities will also transfer over to the merged entity unaffected.

6. There’s no requirement for the LLC’s members to live in Florida after merging the Ohio LLC into a Florida LLC.

7. Merging an Ohio LLC into a Florida LLC has the potential to remove the company’s taxable connection (or economic nexus) to Ohio. Talk to your tax professional about this, as every business’s circumstances will be different.

8. This type of transition lets your company keep using the same EIN to report and pay taxes after its merger. Unless there are errors or omissions in your documentation, all that should effectively change about your business is its formation state.

9. Merging an Ohio LLC into a Florida LLC allows the business to keep using the same bank accounts, the same taxpayer ID, the same operations, and the same contracts that it did before, as long as no mistakes are made during the relocation process.

What Are the Tax Implications of Merging My Ohio LLC into a Florida LLC?

To topOne of the most important parts of preparing to merge your Ohio LLC into a Florida LLC is to familiarize yourself with the possible tax implications of this type of move. Our legal team can only provide some general guidance in these areas, so enlisting the help of a tax professional is essential. Some common implications to discuss with them include:

- State Income Tax: A tax implication that could actually save your company money when merging an Ohio LLC into a Florida LLC is the fact that Florida, unlike Ohio, has no state income tax. The LLC’s federal reporting responsibilities will not be impacted.

- Franchise Tax: While Ohio has a tax similar to franchise tax known as a commercial activity tax (CAT), Florida imposes no such taxes on businesses. The company will need to close any account with the appropriate Ohio State agencies and file final returns if necessary.

- Nexus: A Nexus, or taxable connection to a certain state, is typically created when a company has a physical presence, employees, or substantial activities in that state. If your company still has a nexus in Ohio after merging the Ohio LLC into a Florida LLC, then the tax laws of both states will still apply to the company.

Should I Work With Attorney Patel to Merge My Ohio LLC into a Florida LLC?

To topWorking with our firm can set your company up for a smooth, successful transition from an Ohio LLC into a Florida LLC. Our legal team knows how to avoid the exact pitfalls and mistakes that could sink your company’s relocation. Plus, as a corporate law firm, we offer a suite of services to support our clients that could prove useful, if not necessary, to running a business in Florida.

The project will conclude with a final, comprehensive consultation with Attorney Patel. In addition to getting answers for any remaining questions, they are also provided with a post-merger checklist to help them learn more about their new responsibilities as Florida business owners.

Attempting something as complex as a merger without a lawyer’s help is effectively gambling with your company’s future. By trusting your conversion to our Florida corporate law attorney, you’ll have more time and energy to focus on running your business while we tackle the legal complexities of its relocation, too. Schedule with us now to get started.

Ready to embrace your business’s next chapter in beautiful Florida? Don’t risk your business’s continuity – enlist the help of an experienced business relocation attorney by calling (727) 279-5037, or if your business is ready to move, or schedule a time by using our online calendar.

Image by RiverNorthPhotography from Getty Images Signature Courtesy of Canva Pro.