Overview: Filing Beneficial Ownership Information Reports

To topUpdated: January 10, 2024

Objective:

- To file an existing reporting entity’s beneficial ownership Information report by the deadline of December 31st, 2024, in order to avoid $500 per day fine and/or criminal penalties. An existing reporting entity is a company created in 2023 or prior years. If your entity is created in 2024, you have 90 days to file the report.

- BOI reporting can get complicated. This guide is for small entities that have limited management with only one or two owners of the company.

Entities:

- Limited Liability Companies

- Profit Corporations, Benefit Corporations, and Social Purpose Corporations

- S-Corporations

- C-Corporations

- Limited Partnerships

Additional Information:

You will need the following items to file the report:

- Entity Employer Identification Number (EIN)

- Identifying information for all individuals who own or control at least 25 percent of the ownership interests of the company.

- Identification issued by a US State, or a US or foreign passport for each beneficial owner.

- The full legal name, US residential address, and date of birth for each beneficial owner.

- OR ALTERNATIVELY: the FinCEN ID number for beneficial owners.

Identify Beneficial Owners of your Entity

To topA beneficial owner is any individual who either directly or indirectly:

- Exercises substantial control over a reporting company;

- OR

- Owns or controls at least 25 percent of the ownership interest in a reporting company.

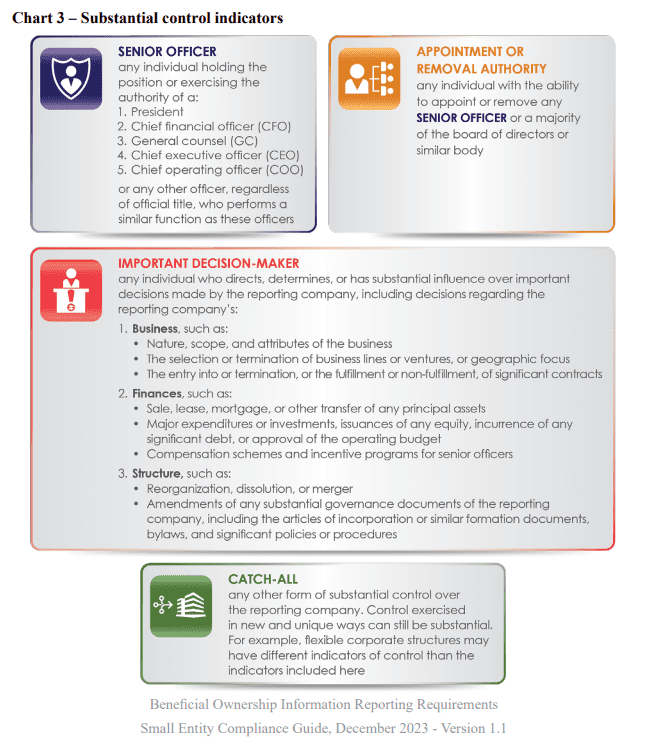

Determine Substantial Control

Reporting companies are required to identify all individuals who exercise substantial control over the company. There is no limit to the number of individuals who can be reported for exercising substantial control. An individual exercises substantial control over a reporting company if they meet any of four general criteria: (1) the individual is a senior officer; (2) the individual has authority to appoint or remove certain officers or a majority of the reporting company’s directors; (3) the individual is an important decision-maker; or (4) the individual has any other form of substantial control over the reporting company. See the chart below for details about these criteria. (See Fincen Small Entity Compliance Guide, December 2023, Question 2.1).

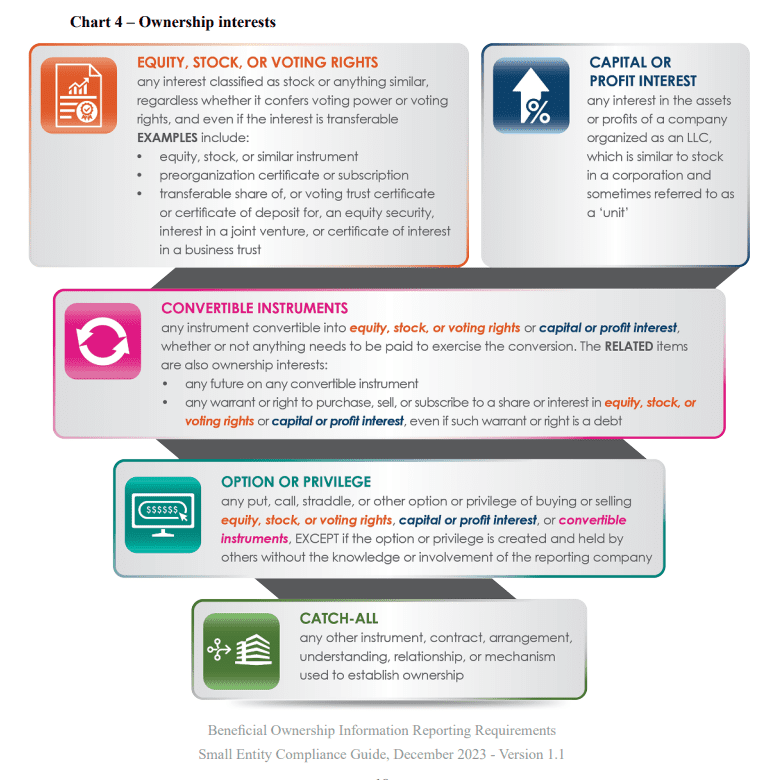

Determine Ownership Interest

Any of the following can count as ownership interest: equity, stock, or voting rights; a capital or profit interest; convertible instruments; options or other non-binding privileges to buy or sell any of the previously listed items; and any other instrument, contract, or other mechanism used to establish ownership. A reporting company may have multiple types of ownership interests. The following chart identifies the ownership interest types and provides examples. (See Fincen Small Entity Compliance Guide, December 2023, Question 2.2).

DIY Guide on Filing Beneficial Information Report for LLC and Corporations formed Before January 1, 2024.

Steps to File Your Report

To topFollow-Along Steps Below:

- Go to Fincen BOI filing system here: BOI E-FILING (fincen.gov).

- Click on prepare and submit “File Online BOIR.”

- Type of filing: select “Initial Report.”

- Request to receive Fincen ID (optional, but recommended by our firm).

- Provide your entity’s name. If you changed your entity name, you can write ABC LLC f/k/a BBC LLC (f/k/a = formally known as).

- Provide your EIN number.

- Provide your jurisdiction of formation or first registration; (if you domesticated your company to Florida, you may be better off using Florida for your company’s jurisdiction so that you submit the most up to date information).

- Provide the current U.S. address where your company conducts business. If you are a virtual business, provide your home address. DO NOT USE your private mailbox or a P.O. box.

- Q#16 – Check this box – Existing Reporting Company

- Part II for information about company applicant will be skipped when you check Q16.

- Provide each beneficial owner’s information.

- Provide the filer’s information and e-mail and submit report

- Download and save the confirmation of the report in a safe area.

Frequently Asked Questions

To topQ: What happens if I cannot get the information from the beneficial owner?

We don’t know yet. This is a fairly new law and reporting requirement. If you’re struggling to get information from a beneficial owner for the BOI Report, here’s what you should consider:

- Document Your Efforts: It’s important to keep a record of all your attempts to get the information. This can be emails, letters, or any other communication you’ve had trying to reach the beneficial owner.

- Get Legal Help ASAP: You have until December 31, 2024, to get the report filed. After that, it’s $500 a day fine and/or jail time for the party not cooperating.

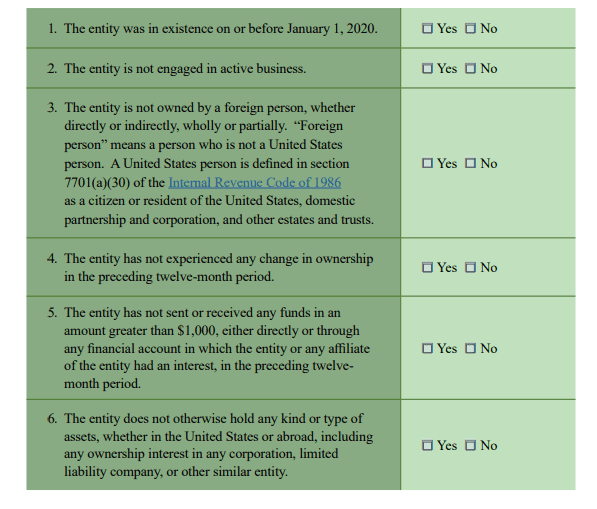

Q: Do I need to file the report if my company is dissolved or if I don’t use it anymore?

You might still need to file a BOI Report even if you aren’t using your company anymore. Here’s the deal: you may qualify for an “Inactive Entity exemption” if all six of the following criteria apply:

Q: Do I need to file the report every year?

No, you don’t need to file the Beneficial Ownership Information (BOI) Report every year. Once you’ve filed your initial report, you only need to file it again in certain situations, such as:

- Changes in Ownership: If there are changes to the beneficial owners or their information (like their address or other details), you need to update the report.

- Other Significant Changes: If there are other big changes to your company’s details that are relevant to the BOI Report, those would need to be reported too.

But apart from these situations, you’re not required to file it annually. Just make sure to keep everything up-to-date with any changes.

Q: How long does it take for the BOI Report to be processed?

It is nearly instant. You will receive confirmation after filing.

Q: Can I make changes to my BOI report if I made a mistake?

Yes, after you submit the report you can make changes to it if the information was incorrect.

Q: What if my entity is owned by another entity?

You will report the beneficial owners of each entity.

Q: Are there any fees required to file my BOI report?

No, there are no filing fees for your BOI report.

Q: Do I need a FinCEN ID number?

No, you will not need a FinCEN ID number under certain circumstances when filing the Beneficial Ownership Information (BOI) Report. Here’s the scoop:

Reporting Companies: If you’re filing the report for your company, you don’t always need a FinCEN ID, as it will only call for your company’s information, like its EIN (Employer Identification Number) or other identifying details.

Beneficial Owners and Company Applicants: The rules are a bit different for beneficial owners and company applicants. They can choose to provide their FinCEN ID instead of providing their full personal details each time they’re reported in a BOI Report by different reporting companies.

Getting a FinCEN ID is optional for beneficial owners and company applicants. It’s like a shortcut to avoid giving out personal info repeatedly. They can apply for a FinCEN ID to use with their reports.

In short, if you’re a beneficial owner or company applicant, a FinCEN ID can make things easier but it’s not mandatory. For reporting companies, it’s more about the company’s details rather than a FinCEN ID.

This guide is for general information purposes only and is not a substitute for actual legal guidance. Your information will be kept private and confidential. It will not be sold to any third parties. By submitting this information the user consents to receive communication via text and email from FL Patel Law PLLC.

[wd_hustle id=”2″ type=”embedded”/]