How to Inform the IRS of Your Business’s Name Change

To topObjective:

- Update the Internal Revenue Service (IRS) regarding recent changes to your Florida entity’s corporate name.

Entities:

- Sole Proprietorships

- Corporations

- Nonprofits

- Partnerships

- Limited Liability Companies (LLCs)

Additional Information:

This task should be completed after changing your company’s name with the Florida Department of State’s Division of Corporations.

After changing your business’s name, you will need to contact the various agencies that the entity is registered with, such as the IRS, to inform them of this name change. You can update the IRS and obtain an EIN verification letter that reflects your business’s new name by following the instructions below.

Generally, there are two ways to go about doing this. The first is to send them notice via mail by writing them a letter noting the name change along with supplemental documents and information.

The second method is only available to corporations, partnerships, and LLCs that are taxed like corporations or partnerships, and involves waiting to inform them on your tax returns for the current year. However, because of the significant delay involved in the latter method, many business owners prefer the former so that they can update their information with the IRS as soon as possible. Here, we’ll go over the steps needed to notify the IRS of your name change in accordance with those specific requirements.

Procedure:

Writing to the IRS About Your Business’s Name Change

To topThe easiest and fastest option available is to write to the IRS directly to let them know about your business’s new name and to request an EIN verification letter. This is also the only option available for Sole Proprietorships and LLCs that are taxed like Sole Proprietorships. When doing so, use the same address that you would when filing your tax return. In this letter, you’ll want to include your business’s old name, its new name, and the effective date of the change. It will also need the signature of either the business owner or an authorized representative (if your business is taxed as a Sole Proprietorship), a corporate officer (if your business is taxed as a Corporation), or a business partner (if your business is taxed as a Partnership).

Sample Letter for Educational Purposes

RE: Business Name Change and 147(c) Letter Request

EIN: _________

Date: _________

Dear Internal Revenue Service,

This letter is to inform you that [Old Name of Entity] (EIN #______) has recently changed its name to [New Name of Entity] with the State of Florida effective as of ____. Please update our records to reflect our new name. We are also requesting an updated EIN verification letter with our new name as well. No other changes are being made at this time.

Signature: _____________________

Name: _____________________

Title: _____________________

This letter must be signed by: the business owner’s or an authorized representative (if your business is taxed as a Sole Proprietorship), a corporate officer (if your business is taxed as a Corporation), a business partner (if your business is taxed as a Partnership), or a director (in the case of nonprofits and other tax exempt entities).

Updating Your Name on Your Current Tax Filings

To topWhen filing your taxes for the current year, you can also use the applicable form to update your business’s name with the IRS by marking the appropriate box. Keep in mind, however, that you will not receive a new EIN verification letter containing your entity’s updated name unless you call or write to the IRS requesting one.

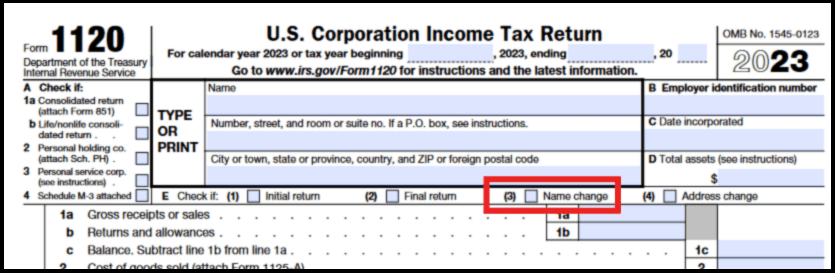

Businesses Taxed as C-Corporations

For Form 1120 (https://www.irs.gov/pub/irs-pdf/f1120.pdf), this will be the third box located on Page 1, Line E.

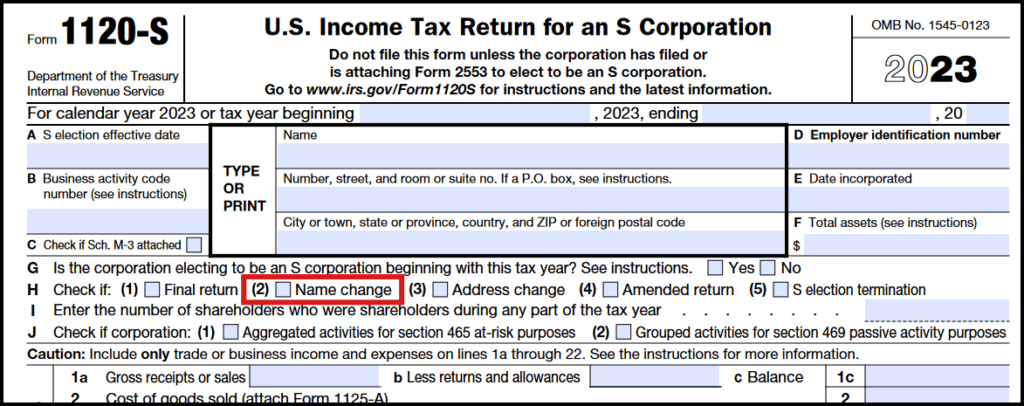

Businesses Taxed as S-Corporations

For Form 1120-S (https://www.irs.gov/pub/irs-pdf/f1120s.pdf), this will be the second box located on Page 1, Line H.

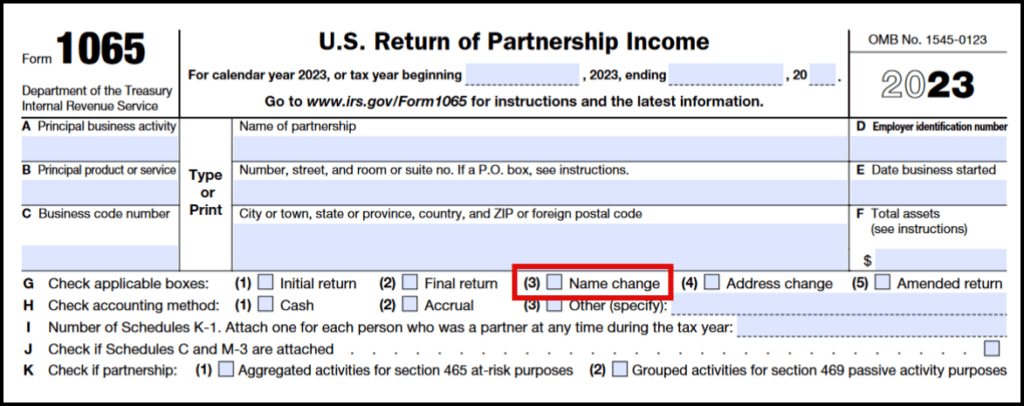

Businesses Taxed as Partnerships

If you are filing for your current year, mark the appropriate box on Form 1065 (https://www.irs.gov/pub/irs-pdf/f1065.pdf).

Tax Exempt Entities

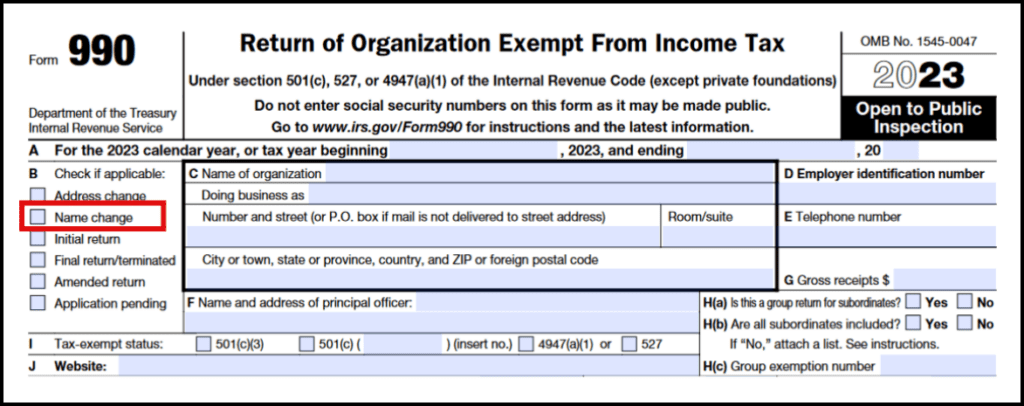

To topNonprofits and other tax exempt entities can also choose to update their name when reporting their annual income to the IRS.

Form 990

The appropriate box for the full Form 990 (https://www.irs.gov/pub/irs-pdf/f990.pdf) will be the second box under Section B on Page 1.

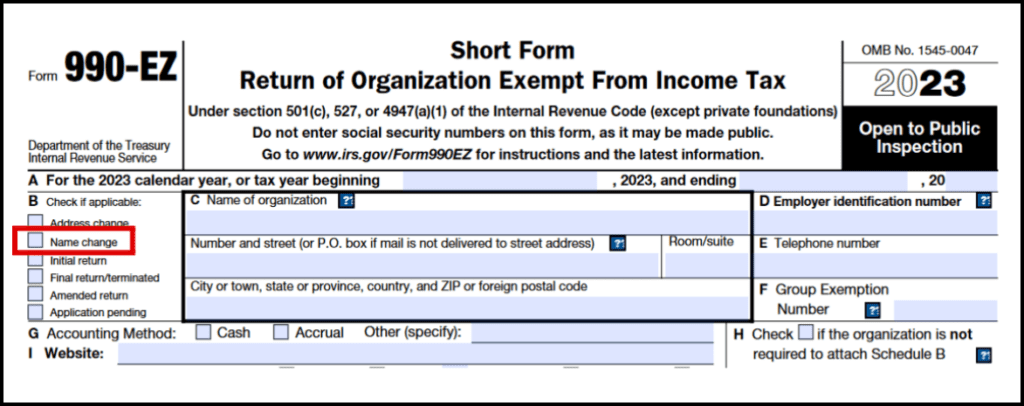

Form 990-EZ

The Name Change field on Form 990-EZ (https://www.irs.gov/pub/irs-pdf/f990ez.pdf) is also located towards the top left of the page under Section B.